H&r block tax knowledge assessment test answers – The H&R Block Tax Knowledge Assessment Test is a valuable tool for tax professionals seeking to demonstrate their proficiency in tax preparation. This guide provides comprehensive insights into the test, including its purpose, content, scoring system, and preparation strategies, empowering individuals to excel in their tax careers.

Understanding the key topics covered in the test, such as tax laws, regulations, and deductions, is crucial for success. The scoring system and time constraints should be carefully considered to optimize performance. By leveraging the resources and tips Artikeld in this guide, individuals can effectively prepare for and confidently tackle the H&R Block Tax Knowledge Assessment Test.

H&R Block Tax Knowledge Assessment Test Overview

The H&R Block Tax Knowledge Assessment Test is a standardized exam designed to evaluate an individual’s understanding of tax principles and their ability to apply them in practical scenarios. The test is widely recognized within the tax preparation industry and is used by H&R Block to assess the qualifications of potential employees.

Individuals who are seeking employment as tax preparers or other tax-related roles should consider taking the test. It is also beneficial for those who wish to enhance their tax knowledge and demonstrate their proficiency in this field.

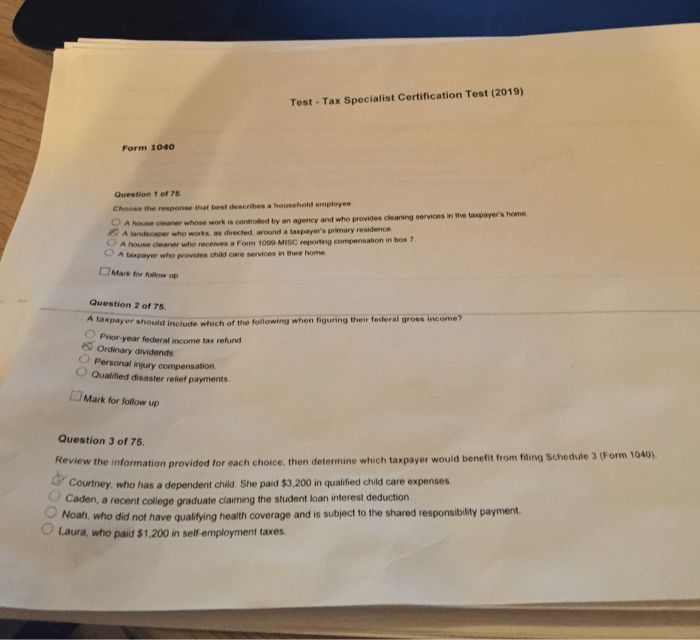

Test Format and Structure

The H&R Block Tax Knowledge Assessment Test consists of multiple-choice questions that cover a comprehensive range of tax topics, including:

- Individual income tax

- Business income tax

- Tax deductions and credits

- Tax filing procedures

The test is typically administered online and has a time limit of 90 minutes.

Preparing for the Test

Effective preparation for the H&R Block Tax Knowledge Assessment Test is crucial for achieving a high score. Here are some tips and strategies:

- Review tax principles:Thoroughly review fundamental tax concepts and regulations using textbooks, online resources, or tax preparation software.

- Practice with sample questions:Familiarize yourself with the format and difficulty level of the test by practicing with sample questions provided by H&R Block or other reputable sources.

- Seek professional guidance:Consider enrolling in a tax preparation course or seeking mentorship from an experienced tax professional to enhance your understanding and practical skills.

Common Pitfalls to Avoid

During preparation, it is essential to avoid common pitfalls that can hinder your performance on the test:

- Procrastination:Start preparing early to avoid last-minute cramming and ensure adequate time for thorough review.

- Lack of focus:Stay focused on the relevant tax topics and avoid distractions during your study sessions.

- Overconfidence:Do not underestimate the difficulty of the test. Even experienced tax professionals may encounter challenging questions.

Test Content and Scoring

Key Topics Covered

The H&R Block Tax Knowledge Assessment Test covers a comprehensive range of tax topics, including:

- Individual income tax:Taxable income, deductions, credits, filing status, and tax rates.

- Business income tax:Business structures, income and expenses, deductions, and tax rates.

- Tax deductions and credits:Itemized deductions, standard deductions, and tax credits.

- Tax filing procedures:Tax forms, filing deadlines, and electronic filing.

Scoring System

The test is scored based on the number of correct answers. A passing score is typically required for employment or certification purposes. The specific scoring system may vary depending on the employer or organization administering the test.

Difficulty Level and Time Constraints

The H&R Block Tax Knowledge Assessment Test is designed to be challenging and requires a solid understanding of tax principles. The 90-minute time limit adds an element of pressure, so it is important to manage your time wisely during the exam.

Using Test Results

The results of the H&R Block Tax Knowledge Assessment Test can provide valuable insights into your tax knowledge and proficiency.

Interpreting the Results:Review your score carefully and identify areas where you excelled or need improvement. This can help you target your future studies and professional development.

Implications of Different Scores

High Score:A high score demonstrates a strong understanding of tax principles and may qualify you for advanced roles in tax preparation or consulting.

Passing Score:A passing score indicates that you have met the minimum requirements for employment or certification.

Low Score:A low score may indicate a need for further study or professional development to enhance your tax knowledge.

Career Advancement and Professional Development, H&r block tax knowledge assessment test answers

The results of the H&R Block Tax Knowledge Assessment Test can be used to support your career advancement and professional development. Consider using your score as:

- Evidence of proficiency:Provide your score to potential employers or clients as proof of your tax knowledge.

- Basis for continuing education:Identify areas where you need improvement and pursue additional training or coursework to enhance your skills.

- Foundation for certification:Prepare for and obtain tax-related certifications, such as the Enrolled Agent (EA) or Certified Public Accountant (CPA), to further demonstrate your expertise.

Additional Resources: H&r Block Tax Knowledge Assessment Test Answers

H&R Block Official Website

https://www.hrblock.com/

Tax Preparation Courses and Certifications

- National Association of Tax Professionals (NATP): https://www.natptax.com/

- American Institute of Certified Public Accountants (AICPA): https://www.aicpa.org/

Staying Up-to-Date on Tax Laws and Regulations

- Internal Revenue Service (IRS): https://www.irs.gov/

- Tax Foundation: https://taxfoundation.org/

User Queries

What is the purpose of the H&R Block Tax Knowledge Assessment Test?

The H&R Block Tax Knowledge Assessment Test evaluates the tax knowledge and skills of individuals seeking to become tax preparers or enhance their tax preparation abilities.

Who should take the H&R Block Tax Knowledge Assessment Test?

Individuals aspiring to become H&R Block tax preparers or those seeking to demonstrate their tax proficiency for career advancement or professional development should consider taking the test.

How do I prepare for the H&R Block Tax Knowledge Assessment Test?

Effective preparation involves studying tax laws, regulations, and deductions, utilizing practice tests and study materials, and seeking guidance from experienced tax professionals.